It’s already being billed by Bank of America as “the biggest shock to global trade in modern times.” It’s also been called the “worst two-day wipeout in history!” In total dollars the stock market has plunged more than $11-trillion dollars ($6-trillion in just the last two days of trading), and now Dow futures are set, at the start of my writing this article to tumble another 1500 points. Credit fear gauges are being pointed out as soaring their worst since the 2023 banking meltdown of Silicon Valley Bank & Friends. Hedge funds are being hit with the steepest margin calls since the Trumpian Covid lockdowns of 2020.

Trump, meanwhile, is playing golf with the Saudis at one of his own resort championships where he is making bank from all the visitors and dining at Mar-a-Lago in billionaire bash extraordinaire.

The financial market meltdown was underway when President Trump boarded Air Force One on his way to Florida on Thursday for a doubleheader of sorts: a Saudi-backed golf tournament at his family’s Miami resort and a weekend of fund-raisers attracting hundreds of donors to his Palm Beach club.

It was a fresh reminder that in his second term, Mr. Trump has continued to find ways to drive business to his family-owned real-estate ventures, a practice he has sustained even when his work in Washington has caused worldwide financial turmoil.

The Trump family monetization weekend started Thursday night, as crowds began to form at both the Trump National Doral resort near Miami International Airport, and separately at his Mar-a-Lago resort 70 miles up the coast….

On Friday, as markets continued to tumble, thousands of golf fans visited Doral, as did Eric Trump, Mr. Trump’s son, and Yasir Al-Rumayyan, the governor of Saudi Arabia’s $925 billion sovereign wealth fund. Mr. Al-Rumayyan is also the chairman of LIV Golf, and was there to see its stars compete.

Teed-up, happy and rich again, his legal troubles behind him and more than having made up for the losses, Trump has said he doesn’t care if his tariff wars scar auto manufacturers because people will switch to American-built cars. Some of the rest of us, however, might be a little teed-off about that.

“I couldn’t care less if they raise prices, because people are going to start buying American-made cars,” Trump said in a telephone interview. “I couldn’t care less, because if the prices on foreign cars go up, they’re going to buy American cars.”

His attitude risks a political backlash when Republicans are already wary about the electoral impact of a slowing economy and Trump’s policies, with Florida special elections for the House this week threatening to embarrass the party….

Manufacturing processes are deeply integrated with plants in Mexico and Canada. This means that most cars built in the US will become more expensive. And while in theory a US-made car in the future could be immune from tariffs, higher production costs and investment needed to site manufacturing solely inside the United States will be passed on to consumers. In the intervening years, the price of new cars will be thousands of dollars higher, risking industry job cuts.

Trump’s treasury secretary seems not to care, either, about how Americans’ retirement accounts are melting down. He even claims Americans won’t care.

Treasury Secretary Scott Bessent says Americans ready to retire aren’t worried about ‘day-to-day’ market fluctuations.

“Americans who want to retire right now, the Americans who put away for years in their savings accounts, I think they don’t look at the day-to-day fluctuations.

Day to day fluctuations? They certainly care when they become day AFTER day fluctuations that are not so much “fluctuations” as long chutes to the bottom of a burning garbage bin.

“In fact, most Americans don’t have everything in the market,” he added.

Welcome to Social Security hell

That’s right. They have a lot of it in Social Security, but Elon Musk is doing his best to hammer that into oblivion as I write, too, because another article in the headlines below tells at length how the entire “Ponzi” department, as Musk called it, is starting to shiver under Thor’s sledge hammer. That means that one-two punch at 401Ks and Social Security may leave most retirees with nothing….

Doge’s attack on social security causing ‘complete, utter chaos’, staff says

Office closures, staffing and service cuts, and policy changes at the Social Security Administration (SSA) have caused “complete, utter chaos” and are threatening to send the agency into a “death spiral”, according to workers at the agency….

“They [the DOGE brothers] have these ‘concepts of plans’ that they’re hoping are sticking but in reality, are really hurting American people,” said a longtime SSA employee and military veteran who requested to remain anonymous for fear of retaliation. “No one knows what’s going on. They’re just coming up with ideas at the top of their head.”

The SSA website has crashed several times this month. Wired reported Doge staff want to migrate all social security data and rewrite code in months, which could cause system collapse and further outages.

It sounds like God’s appointed wrecking ball is hard at work everywhere. Trump’s team will have this thing (the whole US economy) dead in no time. It’s amazing when you turn the entire US government over to kindergarteners how fast they can bring the whole thing down to the ground. (If you think I’m wrong, come back in another month and point out how wrong I was.)

“It’s just been a lot of craziness, a lot of foolishness. Until they get rid of Doge and the person in office right now, and the Republicans actually get a backbone and stand up for something for once in their lives, things are just going to be complete chaos. That’s really the best word to describe SSA right now, just complete, utter chaos,” the worker added. “They couldn’t understand the coding, so everything they said SSA was doing illegally, they weren’t. Common sense is something they lack. They don’t know what they’re doing.”

Well, OK, but they have “Big Balls.” So, there is that. Nothing a little imaginary testosterone, driven by a high-school brain, can’t solve!

“I don’t think they’re going to stop at 7,000 people lost. If they lose 10,000 or 12,000, they’re running up their high score. They’re able to brag about it.”

A high score, but possibly no SSA checks in the mail or on the wires. But don’t call anyone to ask where your check is … or try to visit a local office to find out because …

Phone services for the public have also been cut, and field and regional offices are slated for closure around the US….

“It’s a concerted attack on the legitimacy of social security itself. The promise that this country has made to the public with respect to income security is being broken.”

The final round of the Ponzi scheme will be down before you know it; then, as all Ponzi schemes go, those still invested in it will get flushed away with nothing. Problem is the final round of “investors” includes all living Americans who have paid into Social Security. But, hey, at least, we got that Ponzi scheme out of the way!

OK, It probably won’t be as bad as the insiders are saying, but notice I have to use the word probably.

The cuts come as staffing is already at a 50-year low despite the agency serving a record number of recipients as the US population above the age of 65 is growing.

Well, let the outgoing SSA staff retire early on their Social Security pension …. and eat cake.

We were, after all, already here:

The office of the inspector general at SSA reported in August 2024 that a record backlog of payment actions impacting social security beneficiaries was due to lack of staffing, increased workloads, and decreased funding for the agency, driving improper payments because staff weren’t available to update records.

Couture noted the operating overhead of the agency, as a share of benefits paid out, has shrunk by 20% over the last 10 years and is now less than 1%. He disputed any claims of inefficiency or waste at the agency, claiming the agency is already a model of efficiency and as effective as possible under its fiscal and staffing constraints.

So, how badly can it fall, really?

He said he was concerned the situation was creating a “negative feedback loop” where, as more employees leave, more work is put on those remaining, depressing morale and inducing more to leave “until the agency ends up in a death spiral with staffing, inducing office closures.”

Great. We’re going to make the remaining staff so miserable, they’ll all leave just as my wife and I were going to retire at the end of this year from our day jobs. That should go well.

“You’re going to see a wholesale collapse in the agency’s service structure. Call wait times will skyrocket, wait times for appointments, processing times, all of it going to skyrocket because there won’t be enough people to do the jobs, which opens the door to privatization.”

And that’s what it is really all about—privatization by Blackrock & Co. I’m sure the billionaire cabinet members who are readying their big corporate buyouts of Social Security won’t let me and my wife fall through the cracks because they care! They will arrive as necessary rescuers because of all the people like us who fell through the cracks into the deeper flames of hell in order to pretend to save all the future retirees who can conveniently invest in Blackheart’s managed funds (because all of that went so well as all the 401Ks got flushed at the same time that Social Security went down into the cracks like a writhing snake on fire).

This week, Musk shared a chart of immigrants receiving social security numbers, falsely claiming they were receiving benefits, though the program of providing social security numbers to legal immigrants began under Trump’s first term as part of program to facilitate employment…..

In 2024, social security direct deposit fraud was at a rate of 0.00625% and less than 1% of social security payments had been found to be incorrect.

This whole scenario is no different than all the years during which congress has chiseled the United States Postal Service to the bone by keeping postage rates to the most miniscule one-penny incremental increases while demanding USPS fund all retirements in their entirety well in advance of retirement … all so congress can bust the thing, and then the billionaires they serve can rush in to take over mail service, which clearly none of them will touch right now at the low rates that exist. Proof of that is that none of them do handle regular daily mail delivery even though there is nothing stopping them.

Once they acquire ownership of all mail service through their roles in government as cabinet members, however, they’ll up the rates “in a free market” to whatever higher level it takes to make a big profit. And that, they’ll say, “is just free markets working for the good of the consumer.” But will they deliver 49-cent mail to Catch-a-Whale Alaska in order to keep the whole union in communication? Of course not. They’ll serve the profitable runs.

In the same way, they are trying now to bust Social Security, which entities like Larry Fink and BlackRock have long had their eyes on.

US commerce secretary and billionaire Howard Lutnick claimed in an interview on a podcast earlier this month that only a “fraudster” would complain about missing a social security benefit check.

Inflamed inflation

Such out-of-touch statements by Trump’s billionaire cabinet members are becoming routine:

In one video in the links below Scott Bessent even says we can solve the problem with China in a way that will “not happen tomorrow but over a number of years” by telling China “you consume more, manufacture less; we’re going to consume less and manufacture more” … like that is ever going to happen or we have that long that we can wait for it to happen. A doable wait, I guess, if you’re a billionaire.

That is Bessent’s idea of a solution to the trade imbalance that currently lets you eat really cheap Chinese food and buy a lot of other things very cheaply. You need to consume less—have less. Eat bugs and be happy. The Chinese, to balance the other side of the equation, need to buy more of what they cannot afford and stifle their economic production just for our sake. If that goes as hoped, then, after a few more years, things will be solved, except that Bessent concedes we’ll still be fierce military competitors and business competitors.

All of this he shares with a smile that oddly twists back downward at its corners like the Grinch’s. He says over the next few years the Chinese MAY have to come around because Trump has broken their business model (and ours, too, I’ll add since nearly everything we make has parts that come out of China, and much of what we sell is manufactured in China). Not to worry, we’ll have this maybe sorted out in a few more years when China gets desperate enough to “come around.”

You have to wonder if he left his brain in the battery charger too long, the charger failed to turn off, and his brain blew up.

Meanwhile, Peter Navarro, Trump’s tariff guru and sorry apologist, told the entire nation repeatedly that tariffs would not cause inflation (while I said every time they certainly would!) Yet, the cost of a new iPhone, thanks to tariffs, reportedly could rise to $3,500!

I doubt it will play out that badly because Apple wouldn’t sell any phones at that price, but …

The tech giant would likely pass these inflated costs onto the consumer, taking the price of a 256GB iPhone 16 Pro from $1,100 to an eye-watering $3,500, according to Wedbush Securities analyst Dan Ives.

Apple can, of course, move all production to the US …. in a number of years! … but that may not help the price all that much because the critical materials it uses to make iPhones will still have to be imported from China, which may place export tariffs on those materials just to raise the price even more than Trump’s import tariffs. Hence, the sudden need to acquire Greenland where we can strip away the ice and get down to mining rare earth … as in digging into a part of the earth never seen before by human eyes because it has been buried under ice throughout the existence of human beings as we know them.

Given price projections for the totally stuck-in-China iPhone, I think Navarro left his brain on the charger too long, and it blew up, too. These are the great minds that are telling you not to sweat the loss of your retirement funds which are spiraling down the drain so quickly they are making a deafening roar. Not to worry, we’ll have this sorted out in a few years.

Car makers are being hit the hardest, but don’t think the damage will only be among foreign cars or even among new cars. All domestic cars are saturated with foreign components that will shoot up in price. And don’t think you’ll find refuge in used cars. A flood of buyers will either move to used cars because they cannot afford a new one or stay with their current car, keeping many used cars from going on the market. Thus, we’ll see inflationary pressures from both the demand side going higher for used cars and the supply side going lower.

The credit canary stops singing and croaks

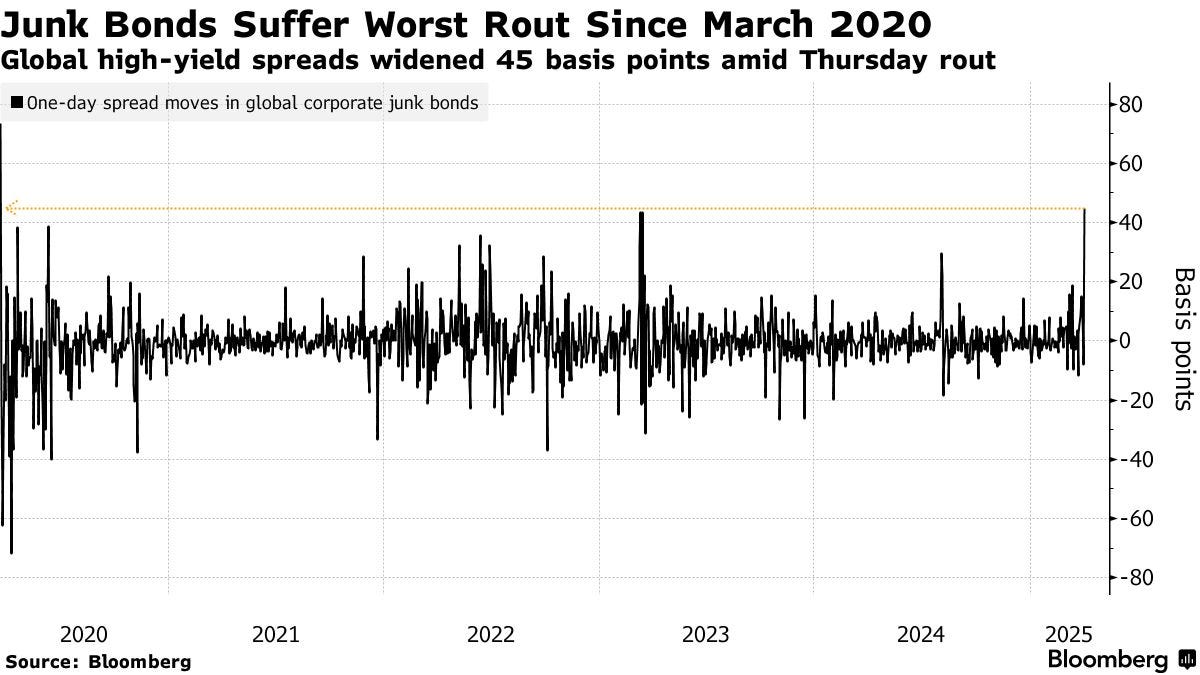

“Corporate credit is the canary in the coal mine for a faltering economy,” we are told, so we might want to take note of the huge sell-off in corporate junk bonds that is about to crater hundreds of zombie corporations—something I predicted five years ago would be a definite part of the crashing Everything Bubble.

Donald Trump’s “liberation day” tariff blitz has sparked the biggest sell-off in the US junk bond market since 2020…. That is the biggest rise since coronavirus triggered widespread lockdowns….

The sell-off in corporate bonds since Wednesday, when Trump took US tariffs to their highest level in over a century, highlights investors’ worries that the move will hit economic output and raise unemployment, leaving weaker companies struggling to repay their debts, analysts said.

There should be no surprise from the dive of the zombies. It’s been long overdue, but it is an example of how the dominoes are now falling in just a week’s time. The zombies just needed a good kick to get to send them walking. As a result, the next big debt default wave is now rolling in.

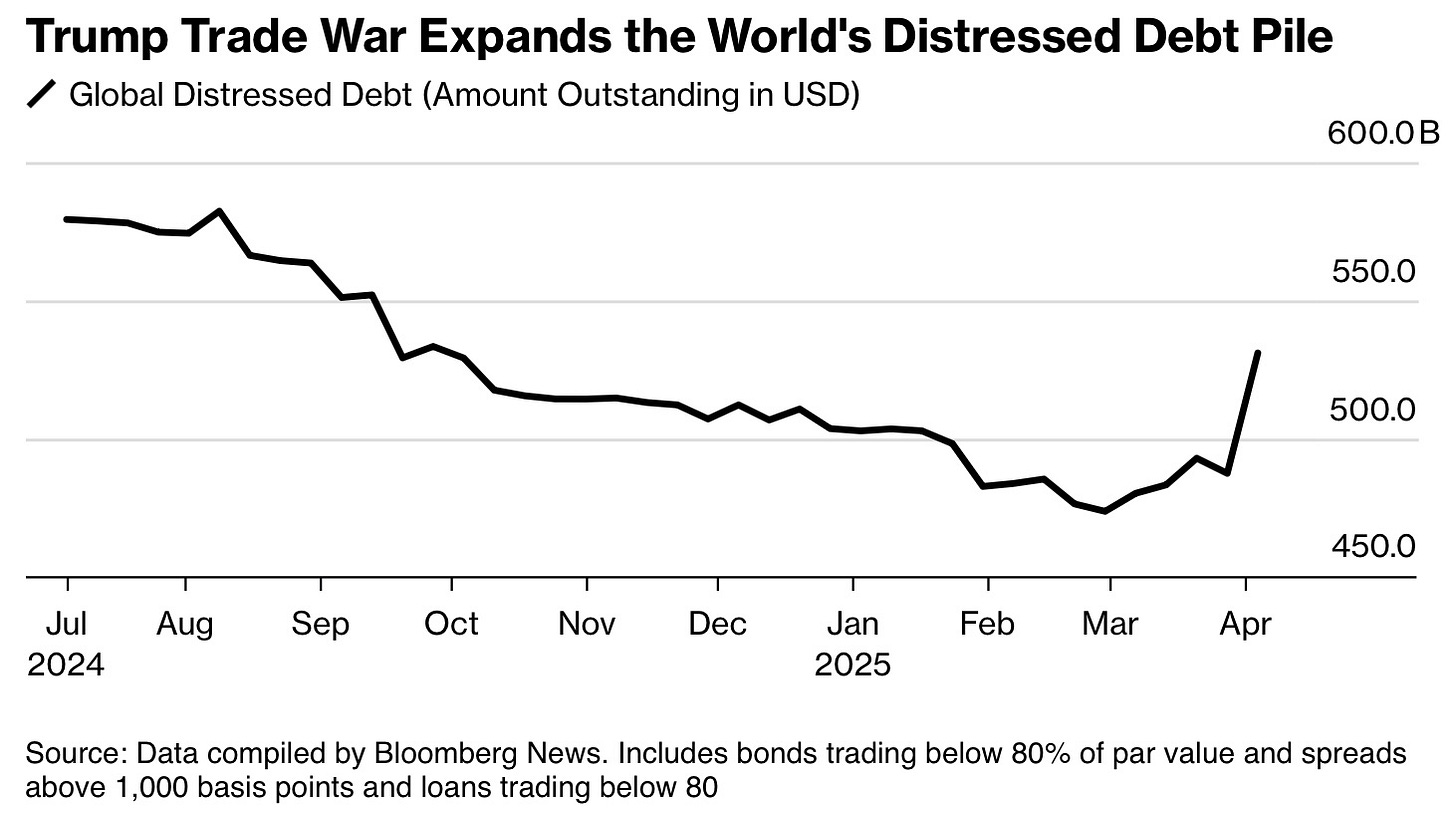

A Bloomberg News measure of distressed debt worldwide swelled the most in at least 15 months this week, sending more than $43 billion of bonds and loans to levels that make it challenging to refinance.

The point is not that weak stuff would not have fallen, but that you can’t launch a full-on trade war with an economy riddled in its own faults and not experience a lot of chaos. That word, in fact, has now become the word that dominates the everyday news, recent news included. Suddenly, no one can stop from using it. I may have been premature in thinking it would fully materialize in the final quarter of 2024, but it’s certainly everywhere now.

The president had telegraphed well in advance his intention to raise tariffs ahead of the official April 2 announcement. But few had expected Washington to go after so many of its key trading partners with such high duties, especially considering the risk of upending global supply chains that entire US industries rely on.

Never underestimate the King of Chaos now that he’s unbridled. In just a few days, distressed debt has done this:

And rapidly rising.

“Retailers are getting smacked,” said Robert Schwartz, a portfolio manager at AllianceBernstein. “If you’re a retailer, you tried to diversify into Vietnam or the Philippines. Those tariffs weren’t priced in until this week….”

The list of companies set to take a direct hit from tariffs is long: among them household goods chains like Wayfair, department store chain Nordstrom, accessories brand Claire’s, and animal products manufacturer Petsafe….

The owner of luxury department store chain Saks Fifth Avenue was one of the biggest additions to the distressed universe. A $2.2 billion bond that it issued less than four months ago to finance the acquisition of Neiman Marcus Group is now trading at 73.5 cents on the dollar and yielding 16 percentage points more than Treasuries, according to data compiled by Bloomberg.

The Trump tornado has struck.

General economic malaise due to credit crackup

JPMorgan Chase went in one week from predicting a 40% chance of recession to 60% to what now sounds like a 100% assurance on their part of recession. Some people, you may recall, said a week ago they didn’t see a sign of recession anywhere in sight. Too bad for their eyesight. Buy better glasses or spend more time reading here.

“We expect to see elevated levels of distress and potential restructurings across the retail and consumer sectors akin and likely greater than what we saw during the last wave of tariffs,” said Alex Raskin, a managing director at Houlihan Lokey. “Other industries that will likely be immediately impacted are energy, homebuilding products and automakers, who are still recovering from supply chain disruptions.”

That’s right. They were still recovering from the supply-chain crisis created in the first round of Trump Tariffs. That’s how long it takes to fix these things when they break.

More than $1 billion of bonds issued by digital advertising company Clear Channel were tipped into distress as a recession may reduce spending for ads.

It all starts sliding quickly now. The news will be filled with an avalanche of these kinds of credit facts as the cost of insuring credit also skyrockets.

Travel, leisure and shipping may be the next ones in line. In the credit-default swaps market, traders were bidding up the cost to hedge against losses on the bonds of American Airlines, United Arlines and CMA CGM.

Speaking of word over the hedge, hedge funds are in big trouble, too. Remember those guys from the good old Great Recession days? They’re back.

Hedge funds have been hit with the biggest margin calls since Covid shut down huge parts of the global economy in 2020, after Donald Trump’s tariffs triggered a powerful rout in global financial markets.

Wall Street banks have asked their hedge fund clients to stump up more money as security for their loans because the value of their holdings had tumbled, according to three people familiar with the matter….

The margin calls underscore the intense turbulence in global markets on Thursday and Friday as Trump’s tariffs announcement was followed by retaliatory duties by China, and other countries readied their own responses. Wall Street’s S&P 500 share index was set to post its worst week since 2020, while oil and riskier corporate bonds have sold off heavily.

“Rates, equities and oil were down significantly . . . it was the breadth of moves across the board [which caused the scale of the margin calls],” said one prime brokerage executive, adding that it was reminiscent of the sharp and broad market moves in the early months of the Covid pandemic.

You can see how rapidly the Trump Tariff War spread through credit markets globally. Within just a couple of days, trading screens looked like a sea of red blinking lights.

According to two people familiar with the matter, Wall Street prime brokerage teams — which lend money to hedge funds — came into the office early on Friday and held all hands on deck meetings to prepare for the large amount of margin calls to clients.

Of course, this starts to put the banks in peril, too, but no worries. Bessent assures us he and China will have this sorted out in just a few short years. Plenty of time for the global crash to finish its dirty work for all. At least, we’re getting it out of the way in the most painful way we can. Rip off the Band Aid!

The report said that the magnitude of hedge fund selling across equities on Thursday was in line with the largest seen on record, as they dumped equity positions at a level in line with the US regional bank crisis in 2023 and the Covid sell-off in 2020.

Good benchmarks to be aiming for. That’s the fun of leverage. It’s all great going up, but it sure accelerates the downfall.

Selling was concentrated in sectors including megacap technology, groups exposed to artificial intelligence across software and semiconductors, high-end consumer, and investment banks.

You remember all that high-tech stuff as the group everyone was saying could not come down in a big crash because they are the wave of the future? Well, the future just got flushed, and the market leaders are now leading the way down, exactly as I kept saying you could expect, just like in the dot-com bust, which I’ve always aid the Everything Bust will look like—only bigger, much bigger. I didn’t have much company when I was making that prediction. That is because we never learn a darn thing from our past.

Suddenly, the leverage is unwinding quickly as hedge funds take their losses and sell their leveraged stocks:

The selling drove US long/short equity fund net leverage, a measure of borrowing used to magnify bets, down to an 18-month low of about 42 per cent, the Morgan Stanley report said.

And that was just last week! Remember me asking last week if you were “tariffied yet?” Well, now everyone is:

‘Everyone Is Terrified’: Business Leaders and Republicans Mum on Tariffs as Markets Crater….

But according to a report by Politico published on Friday, there is a “culture of fear” keeping business leaders and Republicans in line….

“There is zero incentive for any company or brand to be remotely critical of this administration,” said a public affairs operative, who, like others interviewed for this story, was granted anonymity to speak freely. “It destroys your ability to work with the White House and advance your policies, period.”

Loyalty comes with a high price these days. You give up your freedom of speech, but we saw all that stripped away in the Orwellian Biden days. It is just that it certainly is no better now:

An official in the energy industry echoed that sense of fear. “Hearing angst and frustration from all quarters,” the official said via text message, “but no one wants to be first out of the box saying anything negative about Trump’s decision-making….”

“There is absolutely a sense that the administration is keeping a list, and no one on K Street wants to be on it,” said one executive at a trade group downtown….

“I’m trying to say something profound without getting a call from the White House that, ‘You’re next.’”

“What’s the Japanese proverb? The nail sticking up gets hammered down,” the lobbyist added. “On K Street, there’s no value in being the nail sticking up right now….”

“Everyone is terrified,” a senior GOP aide said. “But I don’t think anyone wants to cross the president right now.”

Going global overnight

And, of course, this is happening all over the world, which will reduce demand for US products considerably, even as the price of all US products goes up in other nations under retaliatory tariffs while no other nation’s prices go up under tariffs in other nations because all of them are only fighting a tariff war with the US! We are the only ones disadvantaged. That’s how blatantly stupid it is to pick a tariff fight with the entire world while none of them have a fight going on with each other. Still, the damage to their economies will be great all the same, which will further impact their ability (or desire) to buy our products:

In a blow to Chancellor Rachel Reeves’ efforts to balance the UK’s struggling economy, more than 3,700 firms filed for insolvency in March, according to notices filed to The Gazette, where the country’s business closures are advertised. That’s a 32% increase on the same period last year.

Firms already contending with inflation, falling business confidence, supply chain issues and the potential impact of new tariffs, are now having to shoulder the burden of increased national insurance contributions and higher wages. Those that can’t are winding down.

This is Global Shutdown 2.0 for Trump. While he didn’t cause the global shutdown of 2020 and merely presided over the US component of that shutdown, this time he is presiding over the entire operation.

Let them eat cake

With all of that said, the president this weekend enjoyed several splendid rounds of golf with some of the nation’s wealthiest and ate some of the best chocolate cake since cake was served to President Xi of China during Trump 1.0. This he did while racking up huge lodging fees and excellent restaurant revenue, high green fees, etc.

The rest of us, however, will soon reach the level of ire where Trump will need a war with Iran, hoping desperately for a big victory, to take attention off his flailing tariff policies.

Bessent said he wasn’t concerned about the stock market’s negative reaction last week to Trump’s announcement that he was imposing tariffs as high as 54% on the U.S.’ largest trading partners

“The market consistently underestimates Donald Trump,” Bessent told Welker.

He added later in the interview, “Who knows how the market is going to react in a day, in a week? What we are looking at is building the long-term economic fundamentals for prosperity, and I think the previous administration had put us on the course toward financial calamity.”

But whose prosperity? That is the question. I’m pretty sure it is not mine where next year’s retirement prospects rely heavily on our 401Ks and our Social Security—most of the rest of our money having been devoted to getting our mortgage down as low as we could.

Out of touch much, Bessent?

Asked how long Americans will have to live with the economic uncertainty and “hang tough,” Bessent said the administration is “going to hold the course” to impose the tariffs and bring down inflation but didn’t say how long that would take.

You mean like the prospect of $3,500 iPhones and likely soaring prices for used cars? All to be resolved when, in a few years, the Chinese agree to buy more and make less while Americans are forced to buy less because they can afford less?

There’s no question short-term tariffs do cause an increase in price. As Secretary Bessent just said, it’s a one-time increase. It happens. I want to get that down.

That’s what they say: $_it happens! It’s a one-time increase that will be happening over a very long time and apparently a very high increase, given those iPhone projections, even though Peter Navarro assured us there would be “no inflation.” He should have told us to “read my lips” like George Bush infamously did when he promised no taxes then raised them.

I want to wipe the smarmy, twisted, out-of-touch smile off Bessent’s rich face!

“Our trading partners have taken advantage of us. We can see that through the large surpluses. We can see this through the large budget deficits,” he said.

The large surpluses, you idiot, were because Americans love to buy lots of stuff and could once afford to do that a lot easier than the Chinese peasants could. Not anymore. So, Thank you righting that off-balance equation. And budget deficits have nothing to do with trade deficits, you moron! Apparently you went to that same useless economic school (Harvard) that Elon Musk now criticizes Peter Navarro for going to as dissension begins to break out in the Team Trump ranks (also in the news headlines below).

Here is how smart the out-of-touch gang is: (Follow their math.)

In an interview with ABC’s “This Week,” Kevin Hassett, the director of the National Economic Council, also downplayed concerns about the impact of the tariffs on consumers, saying other countries are bearing the brunt of the impact.

“If U.S. consumers are bearing the costs, there’s no reason for the countries to be angry. So the fact is the countries are angry and retaliating,” Hassett said.

Apparently, Hassett has never heard of the lose-lose scenario where everyone loses because all other nations sell fewer products to the US, so make less money and fire more people, while all Americans buy fewer products because they cost so much more so our money doesn’t go as far, so we wind up firing people, too, which means even less buying … and so on … and so on. It’s called a “doom loop.” They’re real. They don’t happen a lot, but they do happen. We saw on in the Great Depression.

And notice how rapidly, even there, the tune from Team Trump is changing:

Later in the interview, he acknowledged that “well, there might be some increase in prices,” but he argued the previous tariff status quo led to a decline in Americans’ real wages.

The previous status quo consisted of the tariffs Trump already negotiated in the case of Canada and Mexico and that he got nowhere at all with in the case of China where he said tariff wars would “easy, so easy to win … just you wait and see.”

Still waiting. Still not seeing.

But, hey, the good news from Bessent is that we’ll have this worked out in a few more years!

Some of the most critical gauges are red-lining

It’s not too surprising, given the glib assurance that this will settle out in a few more years, that credit fear gauges are also spiking … quickly:

Gauges for credit risk are signaling just how nervous investors are getting about what Bank of America Corp. analysts described as “the biggest shock to global trade in modern times….”

Credit concerns intensified a day after US junk-rated bonds led the biggest slump in global high—yield debt since 2020. The extra yield, or spread, investors demand to own the risky debt instead of Treasuries widened 45 basis points Thursday to 386 basis points.

Those gauges of credit unworthiness actually hit WORSE levels than they did during parts of the Covidcrisis:

Most financial markets underestimated the magnitude of tariffs unveiled on Wednesday, JPMorgan Chase & Co. credit strategists Eric Beinstein and Nathaniel Rosenbaum wrote in a note Friday.

That’s because they pay no heed to the warnings and predictions published regularly in The Daily Doom, which doesn’t exaggerate the doom, but just seeks to present it exactly as it truly is so you can see what is really coming. Good luck with getting that from the mainstream financial press that is all about complaining like me right now, but was telling you how there was no recession or stock market crash anywhere in sight only a couple of months ago! They were telling you how AI had years of great profits yet to come so those stocks were gravity-defying. If you were a paying subscriber here, on the other hand, you certainly heard otherwise well in advance of all of this.

“Everything is on the table now, including a recession,” wrote the analysts.

It already was. They just didn’t know it! So, they didn’t tell you.

In the US, bonds from companies in the energy sector fell most [prices fell/yields soared] after oil prices hit a four-year low. It was the worst-performing part of both high yield and investment grade, data compiled by Bloomberg show. Refining company PBF Energy’s 7.875% notes due 2030 slumped as much as 8.375 cents to 75.5 cents on the dollar, the lowest on record, according to Trace pricing data.

That is recession pricing in.

Junk credit markets had been relatively insulated from the pain being felt in stocks as concerns rose over the impact of trade levies on the global economy. Investors argued that the hefty yields on offer in a high-rate environment offered protection from the worst of the volatility. However, the tariffs sent shock waves through global markets on Thursday, with the S&P 500 suffering its worst trading session in five years and junk bond spreads spiking globally, but most notably in the US.

Sure, Mr. Hassett, this is hurting them more than it is us. Sure….

And all of this was just the opening salvo. Wait until the retaliation tariffs come in. China already set theirs, but the rest are still waiting in the wings.

“Everyone is stunned by what is happening,” Benjamin Sabahi, head of credit research at Spread Research. “The consequences generally speaking for the credit market is that inflation is likely to be back and revenues expectations adjusted downward….”

Well, not everyone. No one who reads here regularly is “stunned.” Well, not as in “surprised.” They knew all of this was coming, including the inflation and the recession in revenues, but I do have to say that watching it actually happen does inspire feeling of awe even when you knew it would come quickly and savagely. You cannot watch T-Rexes kill themselves and not be awed by the strength of the forces at work.

Meanwhile, back at the golf course …

He had driven his father in a golf cart from the military helicopter to the resort dinner the day before, as the festivities over the big moneymaking weekend were getting underway….

The president spent much of Friday at yet another Trump family venue, Trump International Golf Club, not far from Mar-a-Lago, sending out social media messages during the day, including, “THIS IS A GREAT TIME TO GET RICH, RICHER THAN EVER BEFORE.”

Good. It’s working out for someone then.

The big dollar dump

But everywhere else the chaos, itself, continues assessing its own costs:

the negative trends in US governance and institutions are eroding the exorbitant privilege long-enjoyed by US assets, and that is weighing on US asset returns and the Dollar, and may continue to do so in the future unless reversed.

Third, and related, the implementation of the tariffs themselves is eroding the ability of investors to price these. While it is still true that currencies (and Dollar strength) provide the most natural margin of adjustment to US tariffs, as was the case both in the first trade war and also in the first episode of Canada/Mexico tariffs in late-Jan/early-Feb, the constant back and forth on timelines and the rudimentary calculations compound the uncertainty that underpins rising recession risks.

Moreover rather than clearly targeted tariffs that allow precise room for negotiation, with such broad, unilateral tariffs there is less incentive for foreign producers to provide any accommodation — US businesses and consumers become the price-takers, and it is the Dollar that needs to weaken to adjust if supply chains and/or consumers are relatively inelastic in the short term.

One of the points I’ve made is that, when you are foolish enough to target the entire world with a tariff war, you become their only enemy in that war, while all of them become yours. Therefore, they know you will suffer far more than them because you have nowhere left to turn to try to find reprieve from the cost of your own tariffs. It means your own people will be footing the bill for all of the tariffs. No one is left who is seriously concerned about losing market share to other nations to where they might be inclined to sell their exports at a break-even price or even a loss just to maintain market share.

And that leads to this other point I have been forewarning my readers of:

It is the Dollar that needs to weaken to adjust if supply chains and/or consumers are relatively inelastic in the short term.

The upshot is that Goldman’s new base case is now the dollar’s “exceptional” position over the past decade is now reversing, which will benefit the euro and the Japanese yen in particular.

As I’ve put it, what the BRICS currencies never even dared try to do, the Trump Tariffs against the entire world at once are now doing for them! They can just sit back and watch the dollar fall because, in a world where ALL nations need fewer dollars for trade, the value of the dollar will plummet like never before. (Another one of the predictions I’ve already made.) Nothing could be dumber than a unilateral trade war with the entire world! But that is where arrogance takes you—to thinking you’re invincible and can do it all … at the same time.

Of course, the falling dollar should mean foreign stocks purchased in foreign currencies may pay a nice premium over the US stock market. Well, except they’ll likely be crashing into global depression, too.

Here’s a practical example of how this plays out:

The number of cups of coffee Americans drink daily varies slightly depending on the source. According to some reports, Americans collectively consume about 400 million cups of coffee each day. However, a more recent report from the National Coffee Association indicates that this number has increased to approximately 517 million cups per day. This reflects a significant increase in coffee consumption over recent years.

Guess what?

You can’t grow coffee in any of the United States of America except Hawaii. And you can’t begin to grow enough coffee in Hawaii to meet even a small part of America’s daily demand. So you have import it from all around the world (Africa, South America, Central America, Asia).

Want a cup of coffee? You have virtually no choice but to buy it from one of the many economic enemies you’ve made.

In the annals of political stupidity go, there are “own goals” and there are “own goals”. This one is epic.

As reported last week, JPMorgan has called this “the largest tax increase since the Revenue Act of 1968.”

-or-

As a percentage of GDP. In absolute terms, perhaps the largest tax increase in the history of the human race?

Especially if GDP crashes as the Fed’s GDPNow caculator forecasts in joining me.

And, yes, Americans will be paying this tax since we have no nation left to turn to for price relief. You’ll pay in inflation, the illustrious Peter Navarro notwithstanding because this global dynamic is something the US did not experience in the pre-inflation time Navarro relied on for his lame estimation of the zero-impact, something else I warned about: “this time is different, very different.”

And, so, no …

Normalcy will not be returning tomorrow. This is not a “correction.” This is something far more treacherous. The last time the market got thrown into reverse while speeding along up “I-95”, there followed a global financial crisis that reverberates to this day.

So writes one commentator.

Justin Gundlach, a research Scholar at Columbia Law School, added on Bluesky: “The fact that this particular crisis is being bumped out of the top 3 (maybe 5!) on my mental list of ‘big bad things that could be mitigated or avoided with swift, coordinated, prudent action’ is leaving me shook, Madison!”

I.e., he means it’s not going to be be mitigated with swift coordinated action now that Team Trump is talking in terms of not days, not weeks, not months … but years in China’s case.

So hang in there! Because Monday we start round two!

Read the full article here

Leave a Reply