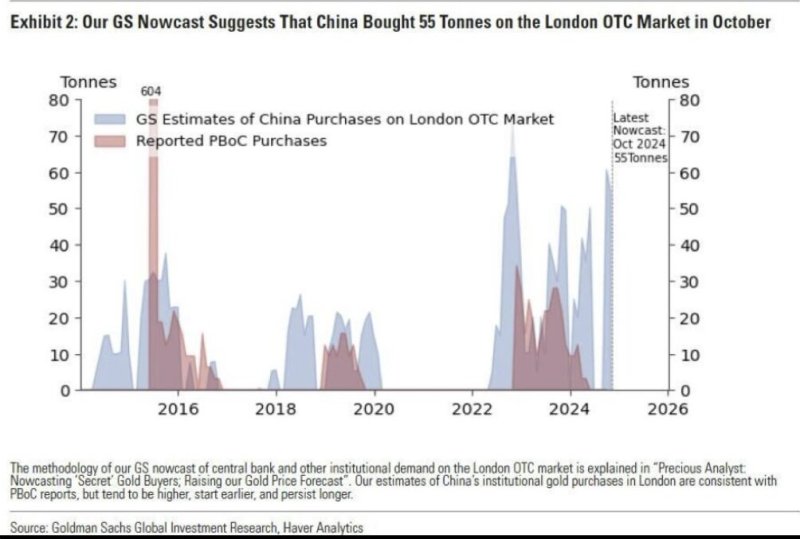

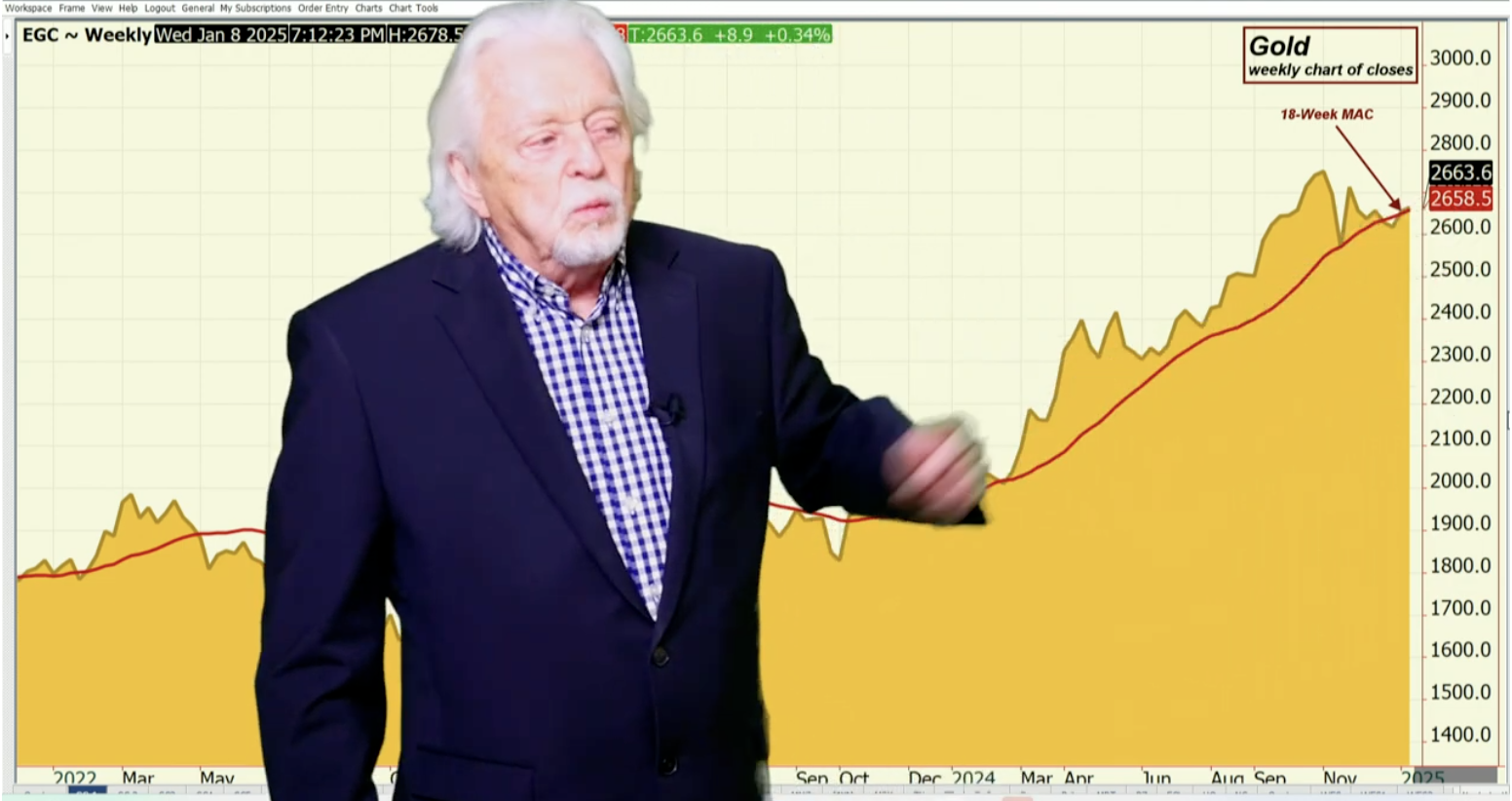

Gold prices are higher in early U.S. trading Tuesday, as Federal Reserve Chairman Jerome Powell is set to speak in front of the U.S. Senate Banking Committee this morning. Gold is trading at $2,365.52, up $6.39. Silver is trading at $31.04, up 28 cents. ING reports gold has surged over 15% in 2024, driven by safe-haven demand amid geopolitical conflicts and central bank purchases. Despite high US interest rates and a strong dollar, gold has consistently traded above $2,300/oz, marking its best performance since the COVID-19 pandemic. Optimism about potential US interest rate cuts has further supported gold’s outlook. Central banks, particularly in emerging markets, continue to buy gold, although China’s purchases have slowed. Gold ETFs also saw positive inflows in May after a year of declines. The ongoing geopolitical tensions and economic uncertainties are expected to sustain gold’s bullish momentum, with prices potentially peaking at $2,350/oz by the year’s end.

Read the full article here

Leave a Reply