Head of Armstrong Economics, Martin Armstrong, says market “manipulation” dominates the financial markets. The “Forecaster” outlines his market outlook for 2025.

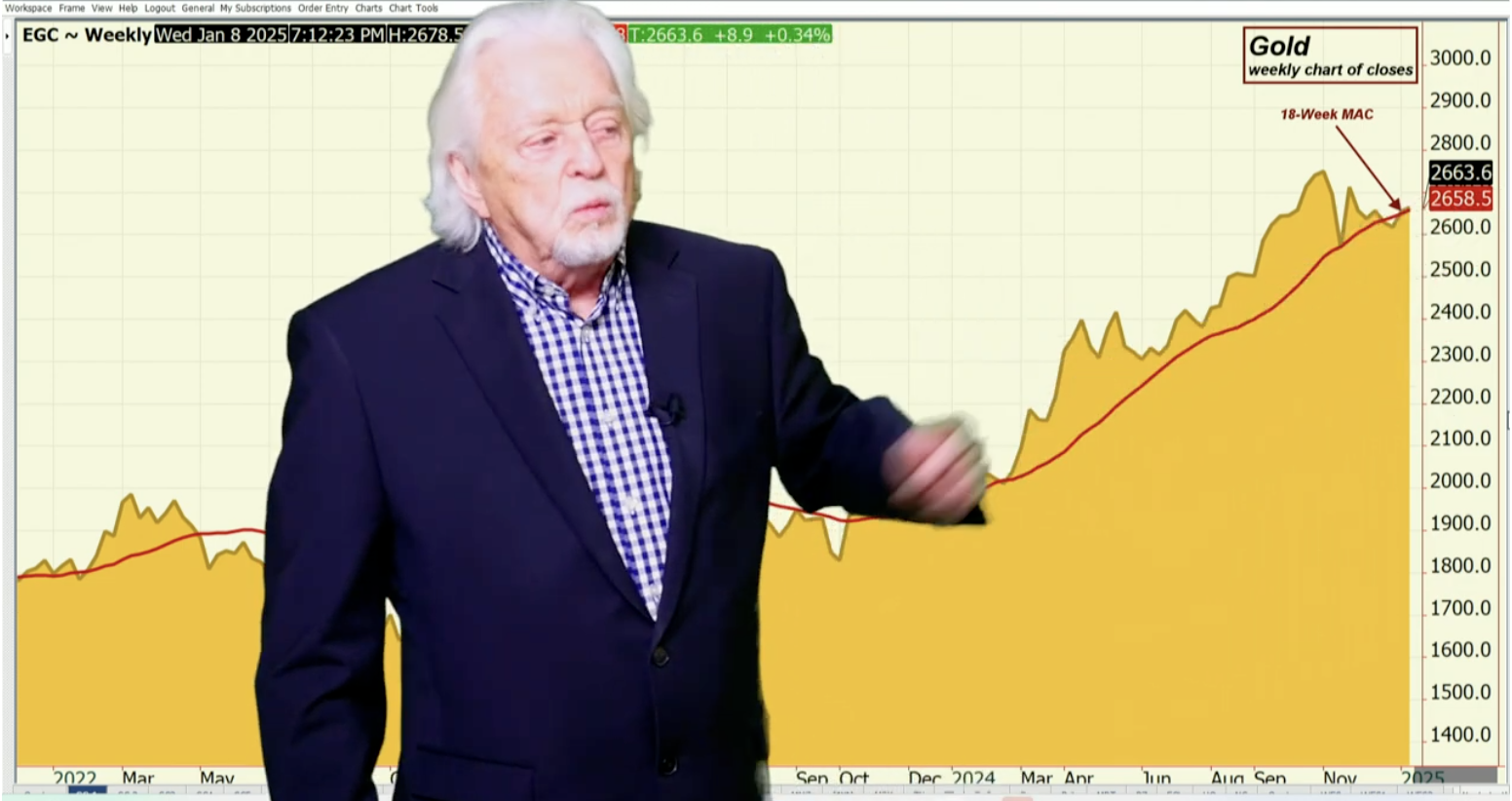

– Gold is moving higher because global capital is nervous.

– In-depth geopolitical analysis.

– Will the Ukraine conflict escalate via a domestic false flag event?

– Is the interest payment on US debt $1 trillion annually?

As I’ve said on your show before there’s a shift between the public to the private. We’ve seen that in France before; the government has now fallen. All right. The French government—you know—interest rates went above corporate. Now, before the government fell…they rose above that of Greece. So, it shows real money. They know what’s going on.

And so, you know, I’ve said for years: forget when the gold bugs say, “Oh, gold will go up and everything else down.” I said it doesn’t work that way. Gold would go up with the Dow. Why? Because it’s a confidence question. When people are fearing war overseas, some people want to buy stocks, some people want to buy gold, and others buy real estate…

– Is a sovereign debt default imminent?

– Will economic sanctions backfire?

– Is free trade the roadway to global peace?

– Why are so many global politicians seemingly pro-war?

– Will Eurodollars continue to pour into the US on debt-default risks?

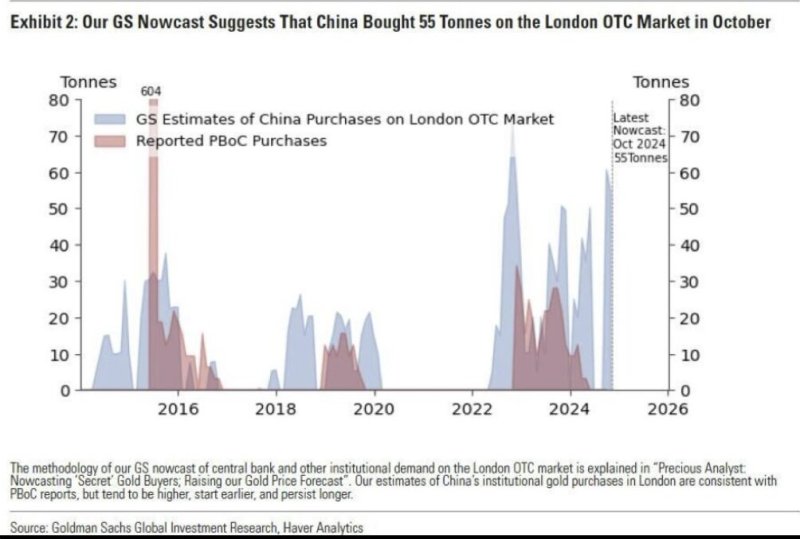

– Why are central banks buying so much gold?

Today, the government is the biggest borrower in the room. So the Fed lowers rates a couple times here because it’s realizing the interest expenditures of the government is exploding. So, the Fed cannot control inflation anymore. All its tools are out the window.

Step back and take a look at this. All these people—”Oh, what’s the Fed going to do?”—it’s irrelevant. The Fed can’t do anything anymore…

Yeah, you’re looking at stagflation because mainly most of it is going to be the escalation of interest expenditures.

Please support the show by subscribing to our Substack with

– Forecaster, the new movie on Socrates and Martin!

Product Code: SNXJH8KBHZHRWL35

Check out Martin Armstrong’s MUST READ service

Read the full article here

Leave a Reply