Gold prices are slightly up on Wednesday morning. The U.S. released its data point for the day, revealing that the consumer price index (CPI) for July increased by 0.2% compared to June and rose by 2.9% year-over-year. The core CPI also saw a 0.2% rise from June and a 3.2% increase on a year-over-year basis. These figures were generally in line with or slightly below market expectations. The price of gold is trading at $2,453.97, down $11.19. The price of silver is trading at $27.72, down 13 cents.

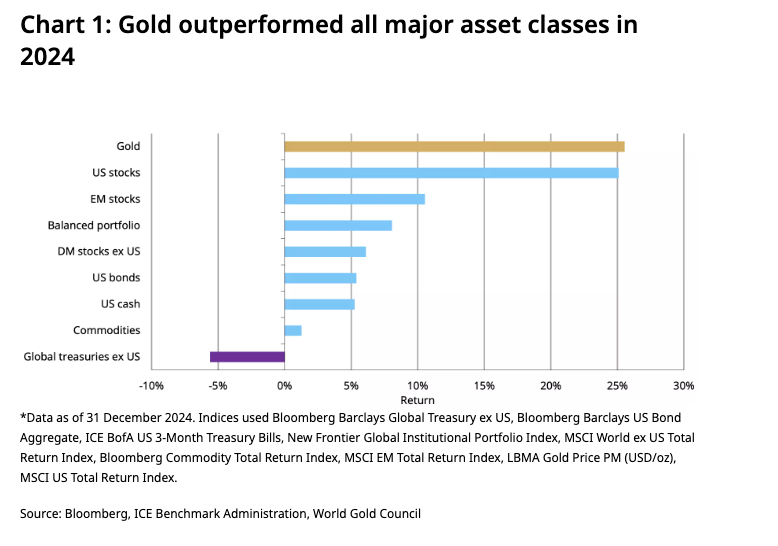

A recent survey by Asset Risk Consultants (ARC) found that 75% of wealth managers have minimal to no exposure to gold, with none allocating more than 10% of their portfolios to it. This trend is mirrored in the U.S., where a Bank of America study revealed that 71% of advisors allocate less than 1% to gold. Despite gold’s reputation as a safe haven, its poor performance and volatility have led to decreased interest, even in gold mining stocks. However, research suggests that gold can significantly reduce downside risk in portfolios. For example, Van Vliet and Lohre recommend a 13% gold allocation for a 10-year investment horizon, while Sprott suggests a 10-15% allocation, including physical gold and gold-like investments.

Further analysis by WisdomTree indicates that adding 16-19% gold to a 60/40 portfolio could maximize risk-adjusted returns, based on 20,000 Monte Carlo simulations over a decade. The IGWT report 2024 also supports a gold allocation between 14% and 18% to enhance the Sharpe ratio of equity/bond portfolios. Although a 40% gold allocation might yield the highest returns, it also increases volatility and drawdowns. Therefore, a balanced approach is recommended, with most studies advocating for a gold allocation between 10% and 19%, aligning with the notion that increasing gold allocation could be beneficial in the current economic climate.

Read the full article here

Leave a Reply