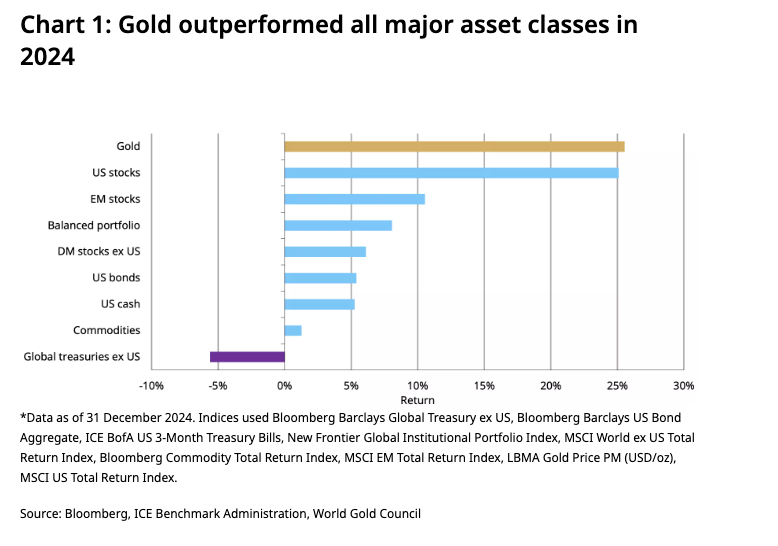

JPMorgan analysts have observed that the “debasement trade” is becoming a lasting trend, with both gold and bitcoin gaining structural importance in investor portfolios. This strategy, which involves turning to assets like gold and bitcoin to hedge against fiat currency devaluation, is driven by concerns over inflation, rising government debt, and geopolitical instability.

The structural rise of gold in investor portfolios is evident from the significant amount of gold held for investment purposes by central banks and private investors. This includes physical gold, gold ETFs, and other investment vehicles. Similarly, bitcoin is becoming an increasingly important part of investor portfolios, with 2024 being described as “a pivotal year” for the crypto market. JPMorgan analysts estimate that a record $78 billion flowed into the crypto space in 2024, including investments in crypto funds, CME futures, venture capital funds, and direct purchases by companies like MicroStrategy.

The analysts conclude that the debasement trade is here to stay, given the growing structural importance of both gold and bitcoin in investor portfolios. This trend aligns with their previous bullish outlook on gold and bitcoin heading into 2025, which was based on factors such as the debasement trade and increasing institutional adoption.

Read the full article here

Leave a Reply