It’s only the 9th of January, but looking at the headlines, it feels like we’re already deep into the year. From devastating environmental crises to a President-elect already reshaping US foreign relations, and a bond market sell-off, the world is off to a tumultuous start.

Today, the United Nations Department of Economic and Social Affairs (UN DESA) will release the 2025 edition of its World Economic Situation and Prospects report. As has become a recurring theme, the authors highlight a significant gap between the story the numbers tell and the underlying realities. This year’s report focuses on critical minerals, a crucial topic as the world undergoes a major energy transition. Regular readers and investors will recognise the pivotal role of silver in green energy technologies, and we’re keen to see how this precious metal features in this year’s findings.

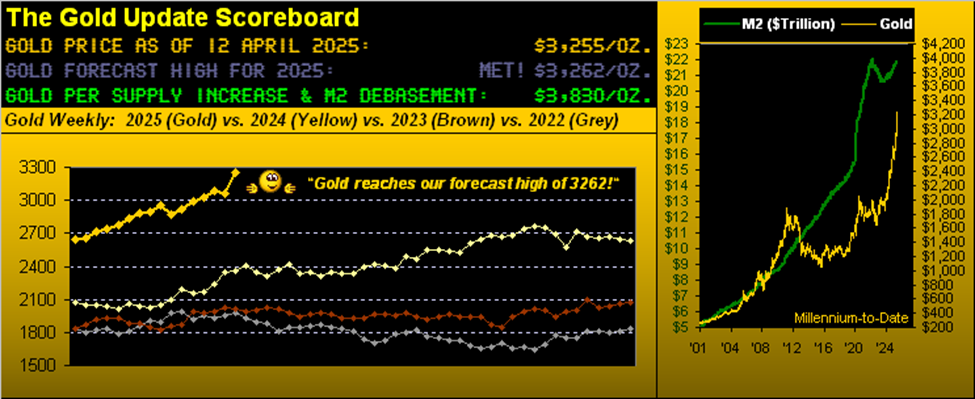

Also today, the World Gold Council released its December market commentary. While gold surrendered some of its gains at the end of the month, 2024 was an extraordinary year for the yellow metal. Gold closed the year 25.5% higher, with the LBMA Gold Price PM setting 40 new all-time highs over the course of the year.

On another note, we’re excited to share our latest interview with precious metals market stalwart David Morgan, also known as the Silver Guru. Recorded just before Christmas, David shares his outlook for gold and silver in the year ahead. We discussed why silver is currently lagging behind gold, the key factors influencing its price, and his thoughts on the broader economic picture, including real inflation, the Fed’s recent rate cuts, and Bitcoin’s evolving role in the financial landscape alongside precious metals.

Read the full article here

Leave a Reply