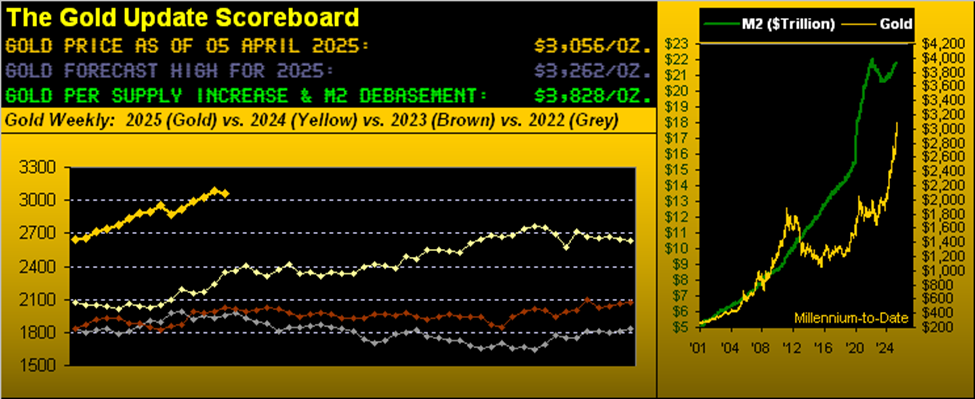

Gold has demonstrated remarkable performance over the past two years, outperforming other major asset classes despite economic conditions that typically don’t favor the precious metal. Traditionally, gold’s performance has been influenced by three main factors: US dollar weakness, low real yields, and increased retail investor demand through ETFs and ETCs. However, a significant divergence has emerged between these traditional drivers and gold’s actual price movements in recent years.

This divergence is attributed to a structural shift in the gold market, driven by two key trends. First, persistent geopolitical tensions have led to increased gold purchases by central banks, possibly as part of a broader de-dollarization effort. Second, rising fiscal deficits and sovereign debt concerns, particularly in the wake of the COVID-19 pandemic, have positioned gold as a potential hedge against sovereign risk and an alternative to US Treasuries. These new factors have supported gold prices even as traditional drivers showed weakening trends.

Looking ahead to 2025, the outlook for gold remains positive. Fiscal concerns and geopolitical risks are expected to continue dominating gold’s performance, with rising fiscal deficits and ongoing geopolitical tensions likely to sustain strong central bank demand. While temporary setbacks may occur, the long-term upward trajectory of gold is expected to persist. The article emphasizes gold’s growing importance as a tool for portfolio diversification and risk management, particularly in an increasingly complex and uncertain global financial landscape.

Read the full article here

Leave a Reply