Gold ETF holdings experienced a decline for the fourth consecutive year in 2024, dropping 3% compared to the previous year. This trend stands in stark contrast to the robust physical gold demand, which reached unprecedented levels exceeding 1,300 tonnes in the third quarter of 2024 alone. The divergence between ETF holdings and physical gold demand highlights a shift in investor preferences, particularly in major markets like China and India, where physical gold has become the favored form of investment.

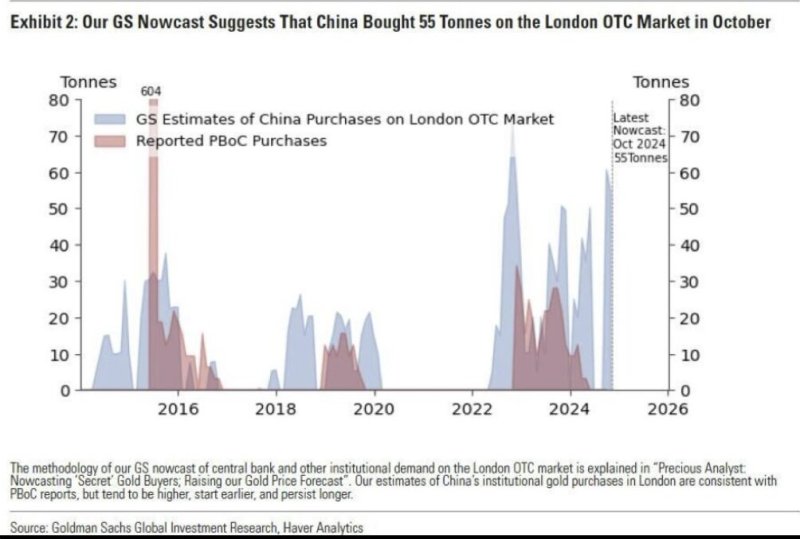

Central banks have played a significant role in driving gold demand since 2022, purchasing a record-breaking total of approximately 2,800 tonnes over the past three years. This aggressive buying spree by central banks, combined with strong consumer demand, has contributed to the overall strength of the gold market. The continued accumulation of gold by central banks underscores the metal’s enduring appeal as a safe-haven asset and a tool for portfolio diversification in times of economic uncertainty.

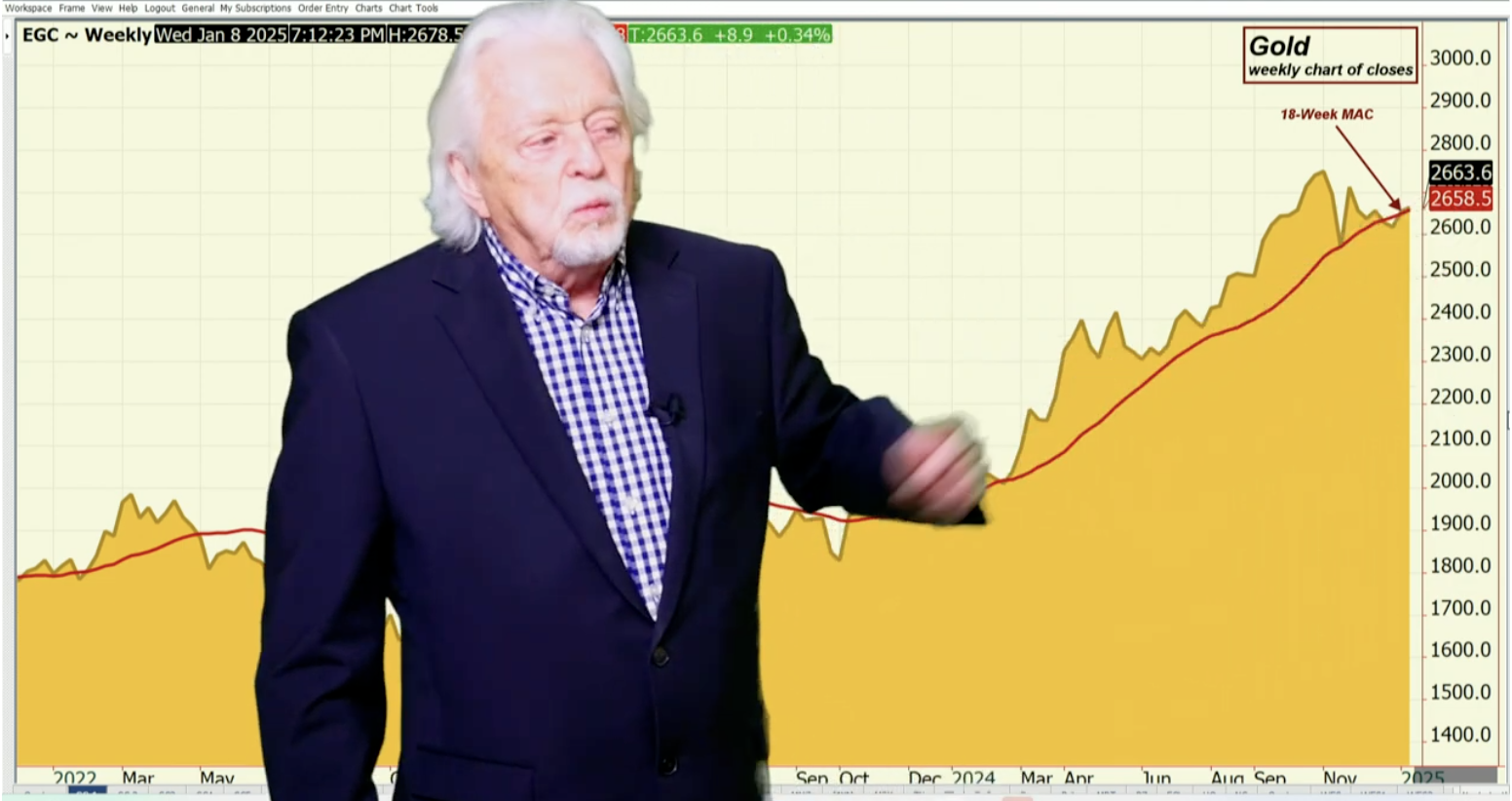

As a result of these factors, gold prices experienced a remarkable rally in 2024, surging by 27.2% and marking the third-best annual performance in over four decades. This impressive price appreciation reflects the strong fundamental demand for gold, particularly in its physical form, despite the decline in ETF holdings. The robust performance of gold in 2024 demonstrates its resilience as an investment asset and its ability to thrive even in the face of changing market dynamics and investor preferences.

Read the full article here

Leave a Reply