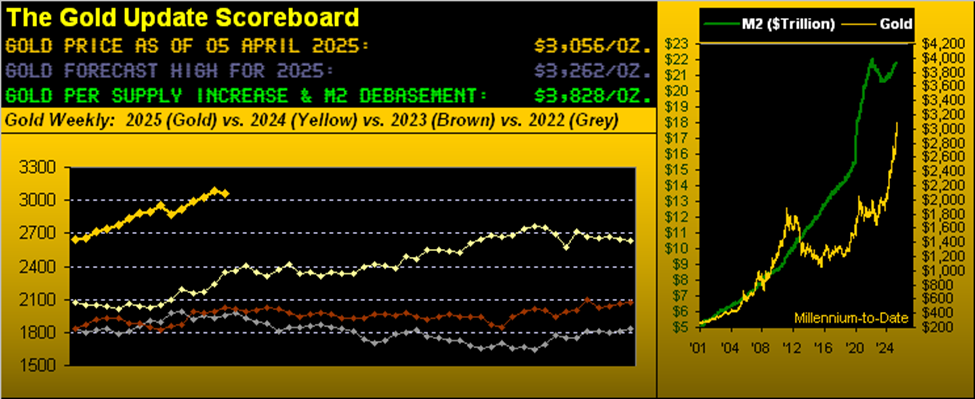

Gold prices are at new all time highs on Tuesday morning. The price of gold is trading at $2765.48, up $23.02. The price of silver is trading at $34.31, up 73 cents.

The recent spike in 10-year Treasury yields and 30-year mortgage rates, despite the Federal Reserve’s decision to lower interest rates, has created a paradoxical situation in the financial markets. This unexpected divergence is primarily attributed to investors’ concerns about the long-term economic impact of the Fed’s aggressive monetary policy and the massive fiscal stimulus measures implemented in response to the ongoing economic challenges. As a result, market participants are demanding higher yields on long-term debt instruments to compensate for the perceived risks of future inflation and potential economic instability. This has led to a steepening of the yield curve, with long-term rates rising faster than short-term rates, putting upward pressure on mortgage rates and other long-term borrowing costs.

In this era of unprecedented monetary policies and market distortions, the importance of owning physical gold extends beyond its traditional role as a safe-haven asset. The current market dynamics, where Treasury yields and mortgage rates are decoupling from the Fed’s intentions, underscore a fundamental shift in investor sentiment and risk perception. This environment creates a unique opportunity for gold to serve not just as a hedge, but as a barometer of systemic stress in the financial system. As central banks continue to navigate uncharted waters, physical gold ownership provides a tangible link to real value, unencumbered by the complexities of modern financial engineering. Moreover, in a world increasingly dominated by digital assets and algorithmic trading, the simplicity and permanence of gold offer a psychological anchor for investors. Its physical presence serves as a constant reminder of wealth preservation through millennia of economic upheavals, providing a sense of security that becomes particularly valuable when conventional market indicators appear to be malfunctioning. As the disconnect between policy actions and market reactions widens, gold’s role evolves from a mere portfolio diversifier to a crucial tool for maintaining financial sovereignty in an increasingly unpredictable economic landscape.

Read the full article here

Leave a Reply