The commodities sector is experiencing a second consecutive weekly gain reports Saxo Bank, with the Bloomberg Commodity Total Return Index reaching a two-month high. This upturn is driven by the Federal Reserve’s surprise 50 basis point rate cut and signals of further cuts, which has boosted various asset classes. The energy sector has rebounded from an early September slump, while softs like sugar and coffee have seen significant gains. Industrial metals, particularly copper, are showing signs of recovery as demand stabilizes and inventories decline. The dollar’s weakness has further supported commodity prices, with most major currencies strengthening against it.

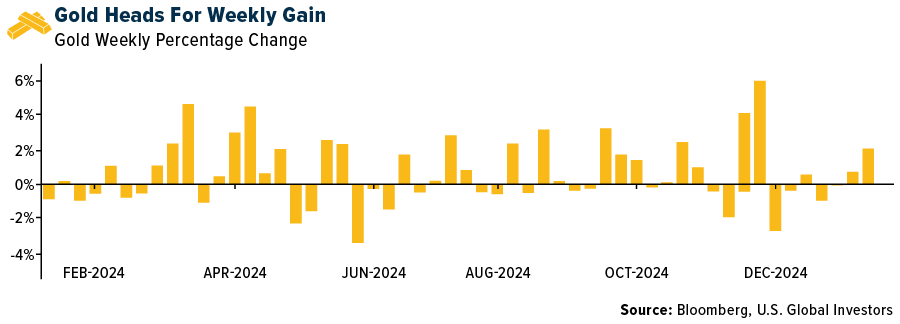

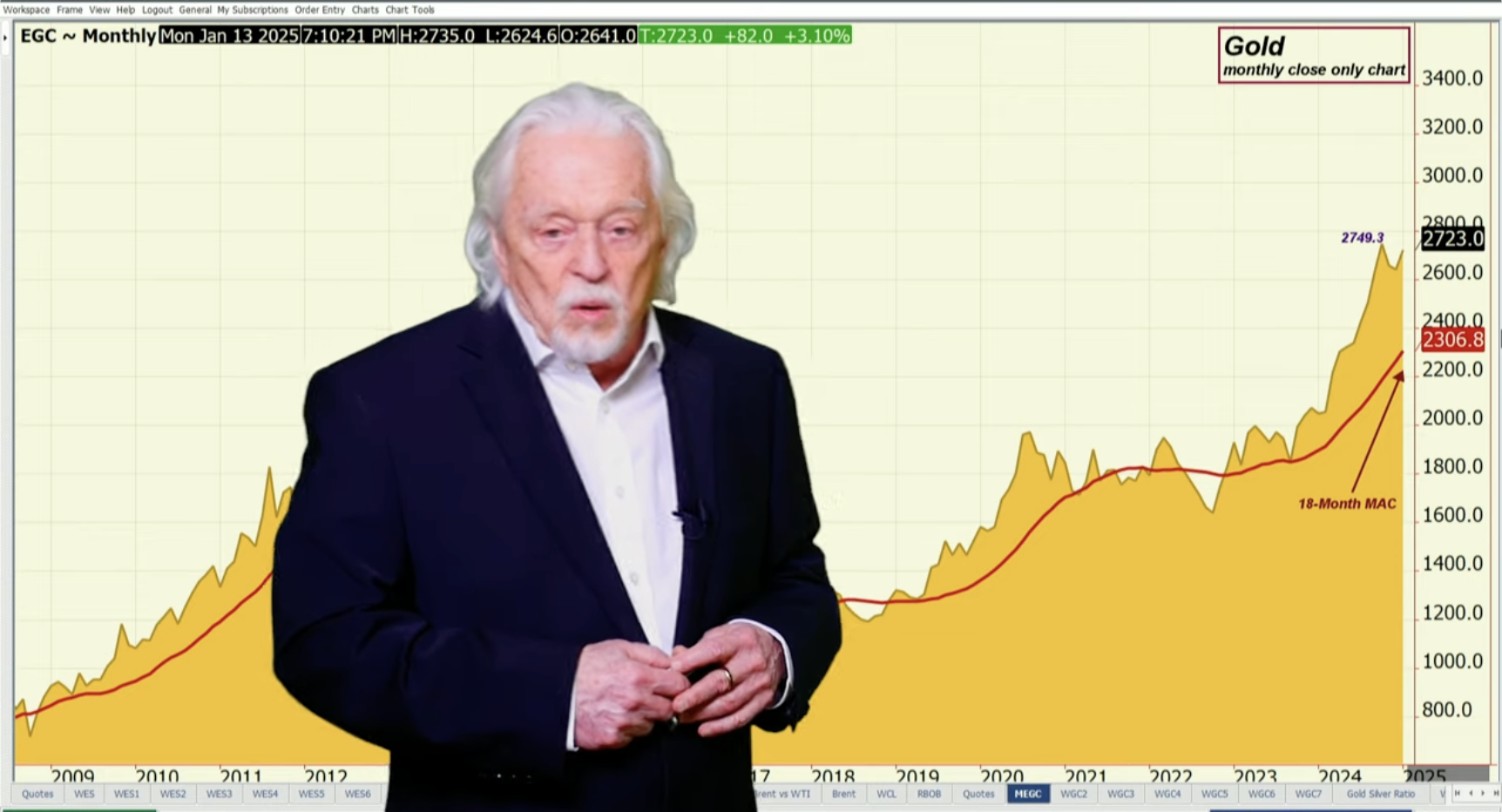

Gold has reached a new milestone, breaking above $2,600 and reflecting a year-to-date gain of over 25%. This surge is supported by multiple factors, including the US rate-cutting cycle, geopolitical tensions, and central bank demand for “de-dollarisation.” A standard 400-troy-ounce gold bar now costs over $1 million, up from $725,000 last October. Gold’s rise, despite being a non-yielding asset, reflects global imbalances and investors’ willingness to pay record prices for its perceived safety and value preservation.

Read the full article here

Leave a Reply